Global Capital Group Portfolio

The Global Capital Group portfolio is diverse and represents our key specialties that include hotels, multi-family units, self-storage facilities, and land syndication.

FUTURE PROJECTS

HOTEL PROPERTIES

GLOBAL CAPITAL HOTEL COLLECTION

And a description of our purchases, redevelopment and rebranding.

2017 – Zalanta, South Lake Tahoe

Development – Phase 1 constructed in 2017, Phase 2 construction starting May 2023 (permit pending), Phase 2 construction costs approximately $75M.

2019 – Hampton, Grass Valley, CA

Development – Purchased a 2-acre property in 2019 and underwent a 3 year entitlement for a 79 room hotel and wine bar. $18M construction project set to commence in April 2023 (permit pending).

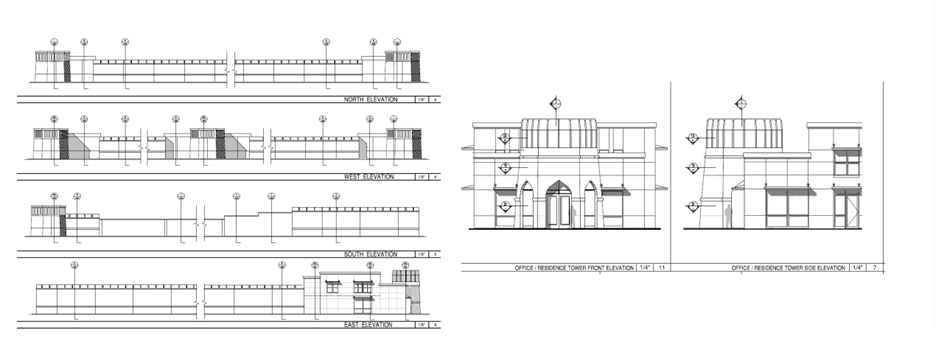

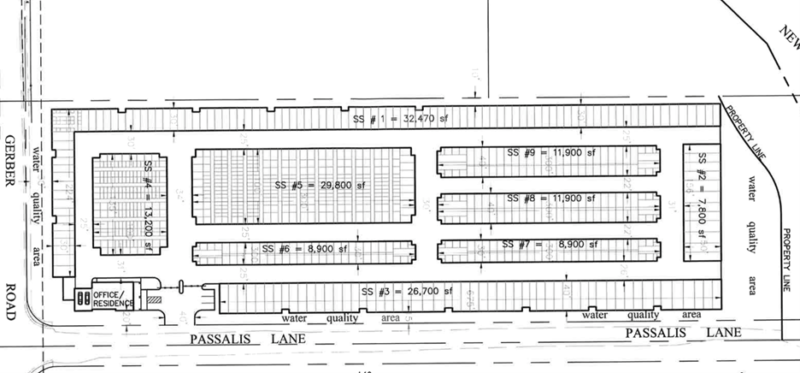

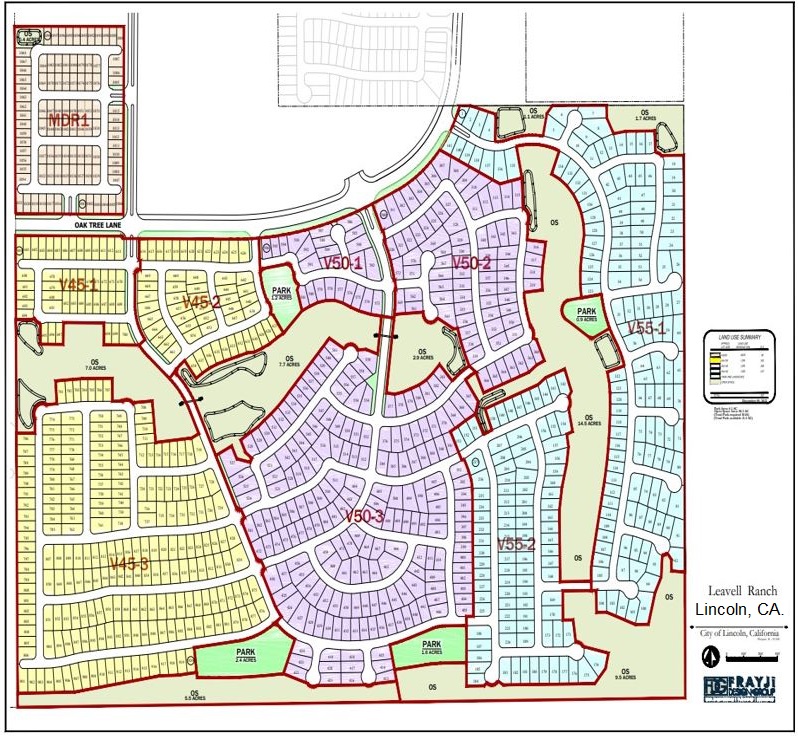

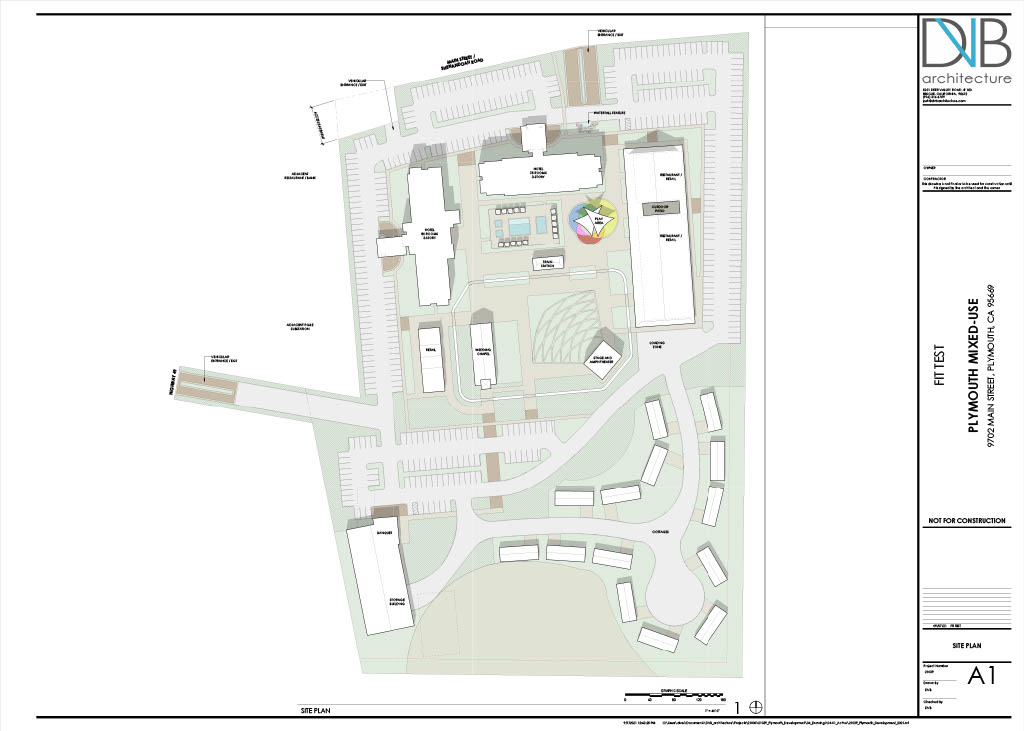

2022 – Hilton, Plymouth, CA

Development – Acquired a 17 acre property in 2021 located in the Shenandoah Wine Country town of Plymouth. Entitlements are underway for 2 Hilton hotels plus 40 for-rent individual cottages. Asset compliments a to-be- constructed casino contiguous to the site, construction timing is second quarter 2023.

2016 – Chimney Cove, Hilton Head, South Carolina

Redevelopment – Acquired a 52-unit apartment community in Hilton Head that overlooks Palmetto Dunes Golf Course in 2016 and current re-entitling for a 102 unit condo hotel. Construction to begin late 2023.

2012 – Best Western, Silverdale, WA

Value-Add – Acquisition of a trophy waterfront property with 150 rooms. Property Improvement Plan of $2M performed in 2012 enabled a rebrand from private to Best Western which increased revenue by 110%. Currently performing an additional Property Improvement Plan of $5M to rebrand the hotel to a Hilton. Anticipated additional revenue increase of 40%.

2015 – Grand Hilton Inn, Hilton Head, SC

Value-Add – Acquired a 79 room privately ran hotel in 2015 located 100 yards from the Atlantic Ocean. Rebranded through a Property Improvement Plan of $6M in 2018 which led to a revenue increase of 275%.

2015 – Best Western Ocean Breeze Inn, Hilton Head, SC

Rehab – Acquired a to-be-condemned hotel and completely remodeled at a cost of $6M. Once rebuilt the hotel was branded a Best Western and currently performs at 80% average occupancy.

2007 – Best Western Plus Hannaford Inn Cincinnati

Value-Add – Acquisition of a privately operated hotel with extensive renovations via a Property Improvement Plan of $3M which enabled the hotel to qualify for a Best Western Plus flag which increased sales 100%. Currently rebranding to a Marriott, additional revenue increase of 40% anticipated.

2016 – Best Western Premier Jacksonville, FL

Value-Add – 164 room acquisition. Fully renovated the rooms and case goods at a cost of $8M. Hotel was sold for a 55% profit.

2018 – Palazzo Lakeside Hotel, Kissimmee, FL

Value-Add – 228 room trophy acquisition that underwent a complete renovation via a Property Improvement Plan of $30M in 2018. Hotel was sold after rehab and stabilization for a 56% profit.

2015 – Clarion Hotel Orlando Airport, Orlando, FL

Value-Add – This property was acquired in 2015. The 330 room hotel had been closed for 5 years. In 2017 we remodeled the entire hotel at a cost of $8M and once stabilized in 2018 the hotel was sold for a 60% profit.

2017 – Stay Sure by Best Western – Clearwater, FL

Value-Add – This hotel was acquired in 2017 and the hotel was shut down. The hotel was opened in 3 months. PIP of $2.5M, 122 rooms. Sold in 2020 for a 25% return.

2022 – Econo Lodge, Stockton, CA

We acquired this 125 unit property in 2022 below market value due to poor operations and spent $2M on remodeling the hotel and branded it as an Econo Lodge. Revenue forecast increase over 100%.

2021 – National Hotel Jackson – Jackson, CA

Value-Add – We acquired this boutique 36 room hotel in 2021. It was originally built in 1853 and underwent major renovation in 2010. We are currently performing a Property Improvement Plan and rebranding the hotel to the Hilton brand Tapestry Collection by Hilton.

2022 – Holiday Inn Express, Rocklin, CA

Purchased in a high barrier to entry market in 2022.